are hoa fees tax deductible in florida

However if you purchased the home as a rental property you can deduct HOA fees since theyre considered a rental expense. Generally if you are a first time homebuyer your HOA fees will almost never be tax deductible.

Are Hoa Fees Tax Deductible Clark Simson Miller

February 23 2020 456 PM.

. Are HOA-fees deductible. Once you figure out the percentage youll use that number to deduct your HOA fees. So lets go over when an HOA fee is tax deductible and when its not.

HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. If you purchase property as your primary residence and you are required to pay monthly quarterly or yearly HOA fees you cannot deduct the HOA fees from your taxes. Though many costs of owning a timeshare are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because they are considered an assessment by a private entity.

Are hoa fees tax deductible. There are many costs with homeownership that are tax-deductible such as your mortgage interest and property taxes however the IRS will not permit you to deduct HOA fees they are considered a charge by a private individual. Yes HOA fees are deductible for home offices.

It is deductible but where is determined by how the land is being currently used. Any HOA that has sizable non-exempt function income may find that they pay. But there are some exceptions.

A Homeowners Association HOA is a governing body that sets specific rules and guidelines that you agree to abide by when you purchase property in a condominium gated community apartment or other type of planned development. You can also deduct 10 of your hoa fees. The answer regarding whether or not your HOA fees are tax deductible varies depending on the situation.

If you are a land developer then it is deductible as a Sch C business expense. While the interest paid on home loans is tax deductible the fees paid to these. HOA fees are typically not 100 percent deductible but you may still be able to claim some portion of them as a writeoff.

Before claiming your HOA fees you will have to determine how much space your home office takes up in your house. Hoa fees range may vary depending on the location of your property and the facilities available to. As a general rule no fees are not tax-deductible.

Are hoa fees tax deductible in florida. The debt portion can be paid off in full which reduces your taxes. If you live in your property year-round then the HOA fees are not deductible.

There may be exceptions however if you rent the home or have a home office. If the land is rented out as pasture for example the the HOA fees are a deductible as a Rental expense then. Filing your taxes can be financially stressful.

Are HOA fees tax-deductible. Both fees are passed through the owners taxes. Are homeowners association fees tax deductible.

IRS regulations can be a little complicated but in general HOA fees are not deductible if the property you. Under section 528 HOAs are allowed to have non-exempt function income. Every homeowners association HOA is different but there are several situations in which you can deduct some or all of your HOA fees.

These fees are used to fund the associations maintenance and operations. While HOA fees arent tax deductible for your primary residence there are other expenses that are deductible. You can reach HOA fees tax deductible status if you rent out your property either year.

Can you negotiate CDD fees. However if the home is a rental property HOA fees do become. If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas.

Though many costs of owning a home are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because they are considered an. Generally HOA dues are not tax deductible if you use your property as a home year-round. Yeah we know thats not a great answer but its true.

As a homeowner it is part of your responsibility to know when your HOA fees are tax-deductible and when they are not. No HOA fees are not tax deductible if the property is your primary residence. It does this with the help of HOA dues fees that the association collects from members.

If the timeshare is a rental property however HOA fees do become deductible. In general homeowners association HOA fees arent deductible on your federal tax return. How you use the property determines whether the HOA fee is tax-deductible or not.

Additionally an HOA capital improvement assessment could increase the cost basis of your home which could have several tax consequences. However there are special cases as you now know. You may be wondering whether this fee is tax deductible.

The short answer is no HOA fees are not tax deductible. The answer is yes and no. A few common circumstances are listed below.

Year-round residency in your property means HOA fees are not deductible. Under the new tax law for 2018 you can deduct. That should make everything a little more clear to you and help keep you out of trouble with the IRS.

If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities. A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood. First though lets take a look at what an HOA is what they offer and what that can mean for you come April 15.

But the profit is taxed at the 30 rate as compared to the corporate tax that starts at 15. For the most part no but there are exceptions.

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Rental Property Tax Deduction Guide Picnic S Blog

10 Easy Home Based Small Business Tax Deductions Learnaboutus Com

Everything About Hoa Fees You Need To Know The Best Guide

Home Buying 101 Tax Benefits For Florida Homeowners

Allowable Deductions For Capital Gains The Friendly Accountants

What Do Hoa Fees Cover And Are They Worth It

Are Hoa Fees Tax Deductible Clark Simson Miller

Florida Villa Rental Taxes Tuscan Ridge

10 Easy Home Based Small Business Tax Deductions Learnaboutus Com

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Are Hoa Fees Tax Deductible Clark Simson Miller

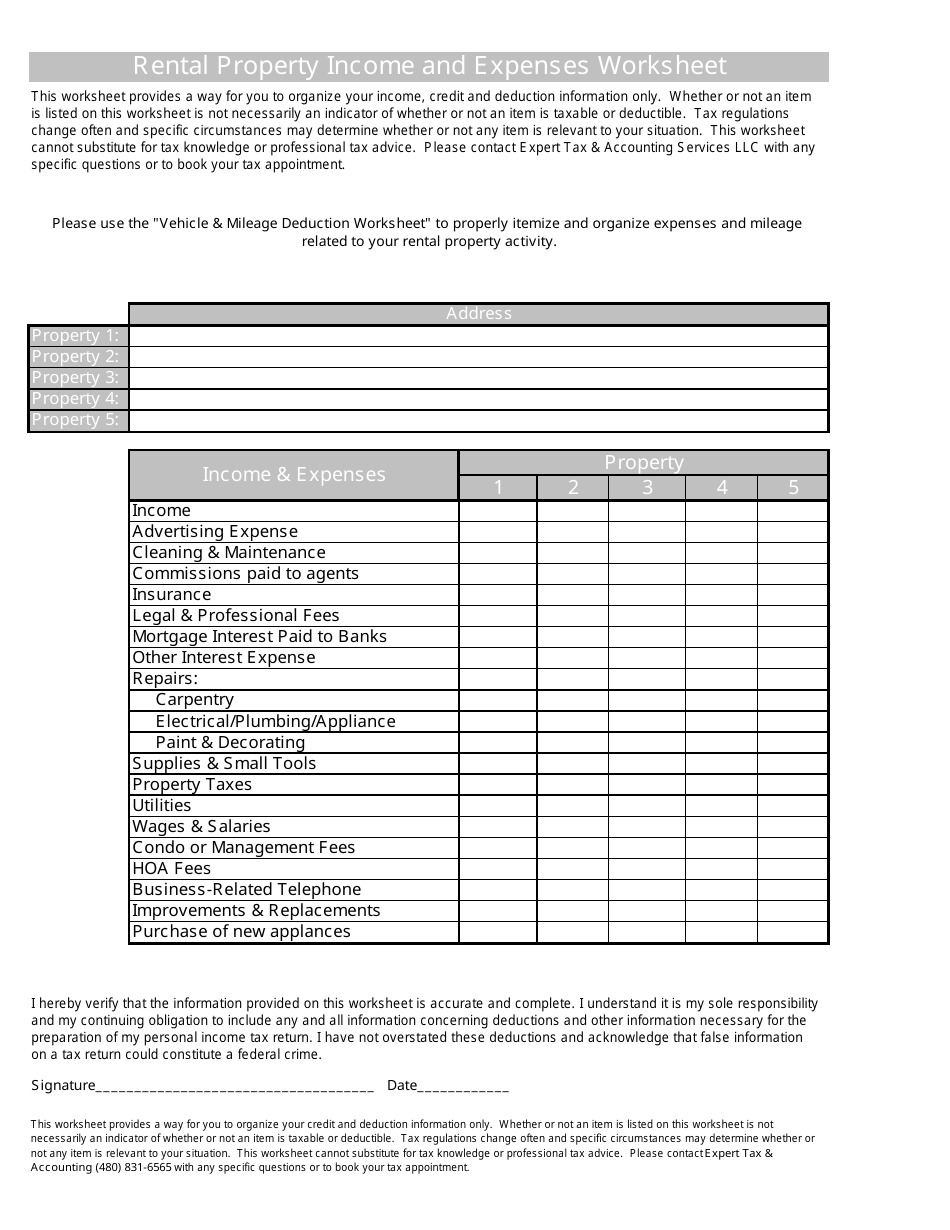

Rental Property Income And Expenses Worksheet Expert Tax Accounting Services Llc Download Printable Pdf Templateroller

Are Legal Expenses Tax Deductible For Your Business Boyer Law Blog

Are Hoa Fees Tax Deductible Here S What You Need To Know

Are Homeowners Association Fees Tax Deductible

The All You Need Checklist Bundle For Homeowners Association Management 8 Free Hoa Checklists Process Street Checklist Workflow And Sop Software